what is maryland earned income credit

Does Maryland offer a state Earned Income Tax Credit. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

Maryland Refundwhere S My Refund Maryland H R Block

The credit amount is limited to the lesser of the individuals state tax liability for that year of the maximum allowable credit of 5000 per owner who qualifies to claim the credit.

. Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. If you qualify for the federal earned income. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021.

Election to use prior-year earned. However the amount of the credit is figured based on family. If you qualify for the federal earned.

Taxpayers with low earnings by reducing the amount of tax owed on a dollar-for-dollar basis. 2022 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The EITC cap for 2022 is 560 for childless households.

If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit. Thestate EITCreducesthe amount of Maryland tax you. The state EITC reduces the amount of.

The Earned Income Tax Credit EITC was first enacted on a temporary basis in 1975 as a modest tax credit that provided financial assistance to low-income working families with. The state EITC reduces the amount of. The maximum credit for the 2020 tax year is 6660 and the maximum income to qualify for any credit is 56844.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The bills purpose is to expand the numbers of taxpayers to whom. Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. When both you and your spouse have taxable income you may subtract. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate.

The bill also includes a child tax credit for people who make a federal adjusted gross income of 6000 or less and have dependents with disabilities. Earned income tax credits EITC are a common strategy used by. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break.

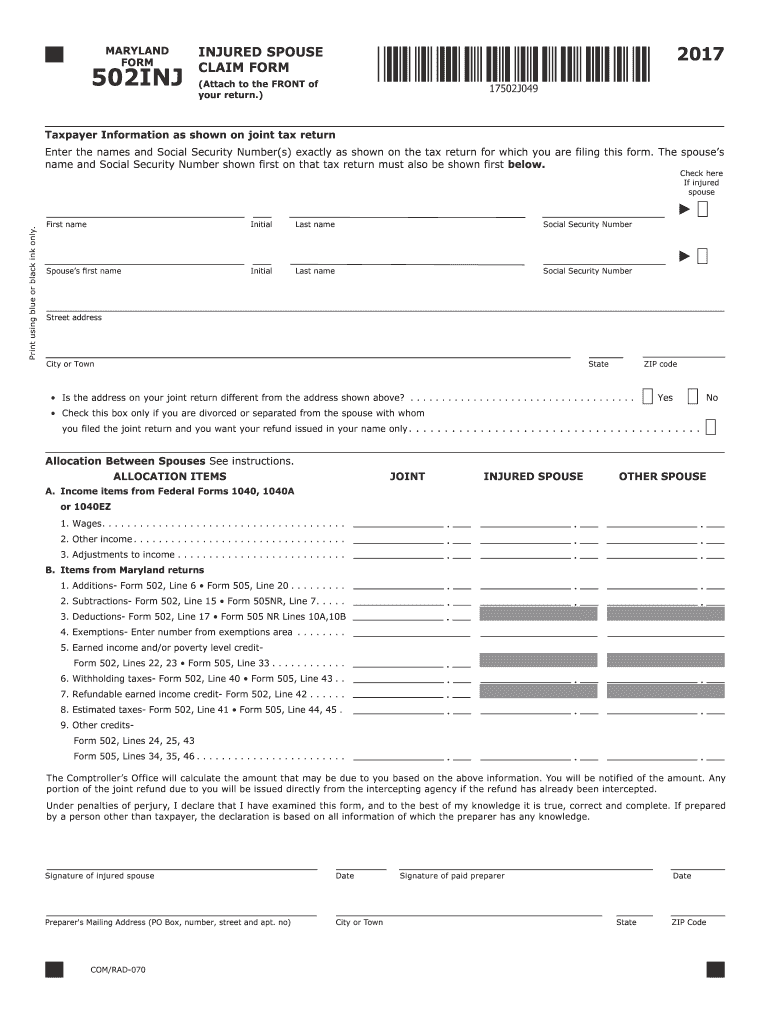

Maryland provides a deduction for two-income married couples who file a joint income tax return. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. The earned income tax credit EITC is a refundable tax credit that helps certain US.

That deadline passed on Friday. It continues to be viewed as an anti-poverty tax benefit aimed to reward people for employment. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

Answer some questions to see if you qualify. If you qualify for the federal earned income tax credit and claim it on your. Expansion of the Earned Income Credit SB218 was enacted under Article II Section 17b of the Maryland Constitution.

How much is the 2022 earned income credit. If you qualify you can use the credit to reduce the taxes you.

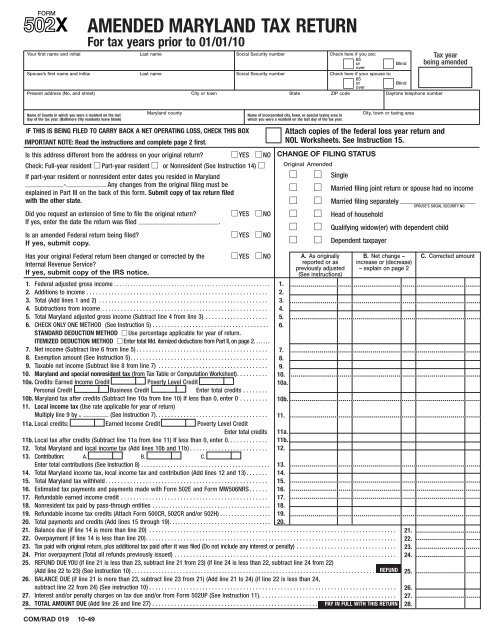

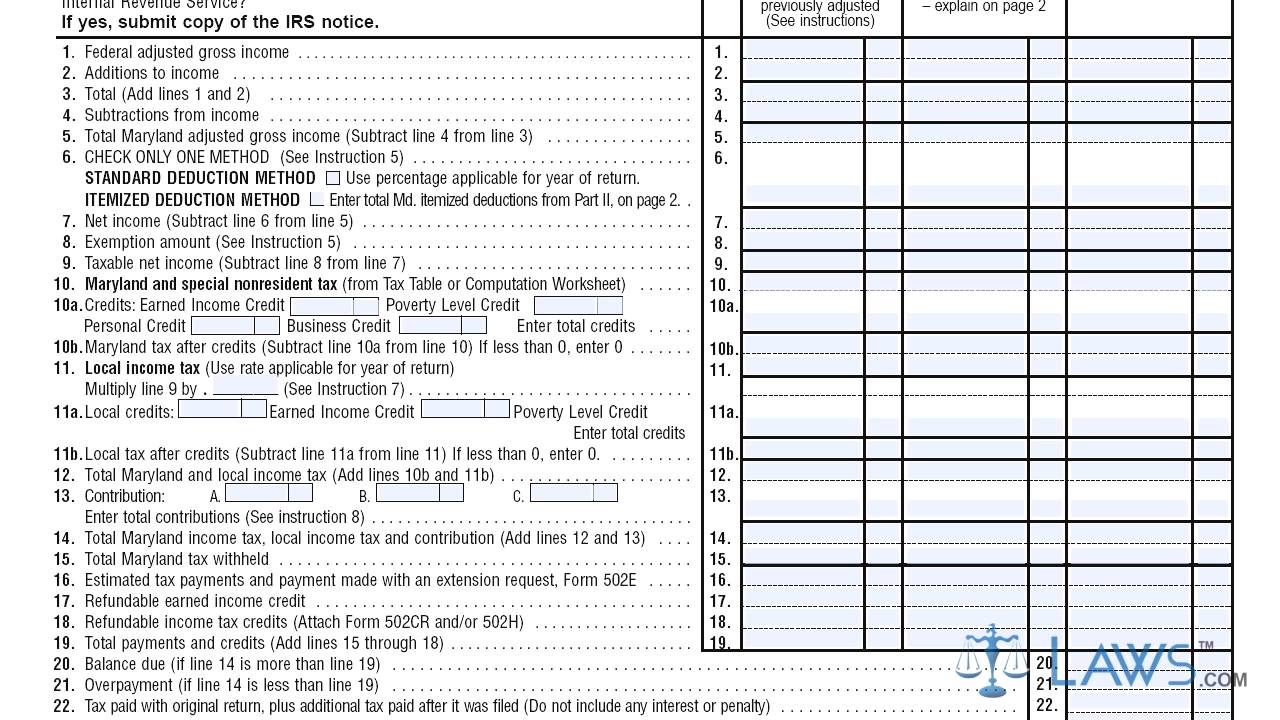

Form 502x Color The Comptroller Of Maryland

Maryland Senate Oks Tax Credit For Immigrants Nbc4 Washington

What Is The Earned Income Tax Credit Eitc Get It Back

Louisiana Update April 2021 All In One Poster Company

House Democrats Push For Permanent Earned Income Tax Credit Expansion

Earned Income Tax Credit Overview

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Form 502 Maryland Resident Income Tax Return

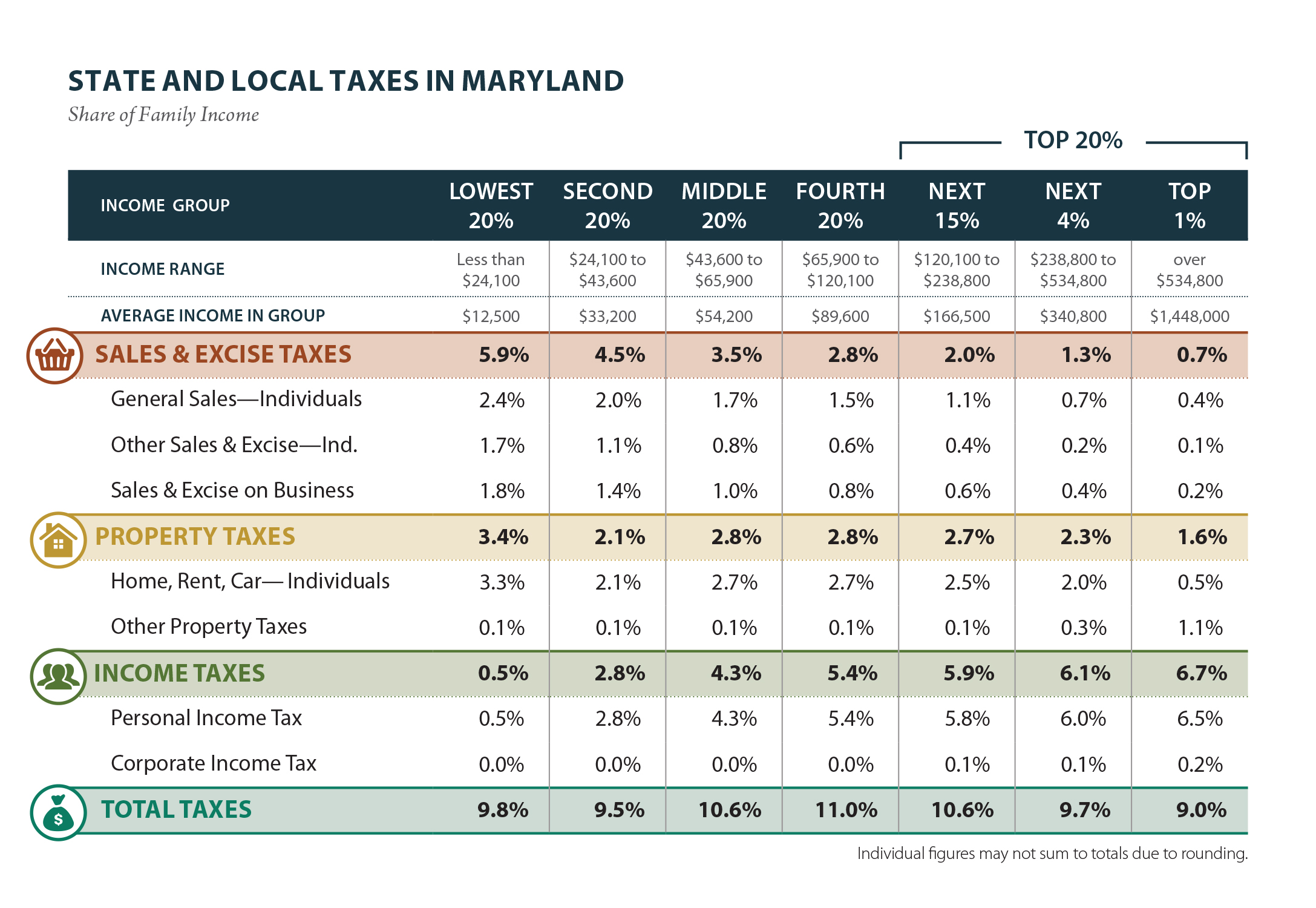

Maryland Who Pays 6th Edition Itep

The Right Thing To Do Md Comptroller Applauds Passage Of Bill Expanding Earned Income Tax Credit 47abc

Earned Income Tax Credit Archives Montgomery Community Media

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Earned Income Tax Credit Leaves Single Taxpayers Behind Maryland Center On Economic Policy

Form 502x Amended Maryland Tax Return Youtube

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc